Tax taken off paycheck

This year individual income taxes were due on May 17 compared to July 15 in 2020. Understanding them can also open your mind that they are not just pure deductions but also benefits you from being a US.

Here S How Much Money You Take Home From A 75 000 Salary

Median household income in California.

. Call 800-829-3676 to order prior-year forms and instructions. The amount of your state tax credit does not exceed 15 of the fair market value of the painting. Disney-owned National Geographic magazine which has 125 editorial staff laid off six of its top editors last week three months after naming a new EIC Matt Stevens New York Times.

And B by adding at the end the following. SmartAssets California paycheck calculator shows your hourly and salary income after federal state and local taxes. See more on President Bidens student loan debt cancelation plan and the potential state tax implications.

The same paycheck covers less goods services and bills. IRS can garnish your paycheck for tax levies the IRS has filed for any purpose such as taxes owed for property and back taxes. These shifting dates must be taken into account when considering year-over-year deficit comparisons.

If your church operates solely for religious and educational purposes your donation will qualify for the tax deduction. Ideas COVID-19 The Top 1 of Americans Have Taken 50 Trillion From the Bottom 90And Thats Made the US. If you had no federal tax withheld from your paycheck and need help navigating your taxes get help from HR Block.

All employees and employers in the United States are required to pay their portion of the Fed MEDEE tax which is taken out of a persons paycheck. The phrase gives three examples of the unalienable rights which the Declaration says have been given to all humans by their Creator and which governments are created to protect. Get married divorced or become a widow.

To be taken out of your paycheck. And as frustrating as it can you must get yourself familiar with these taxes to know where those chunks of your income go. Additionally this year estimated quarterly tax payments were due in April whereas they were due in July in 2020.

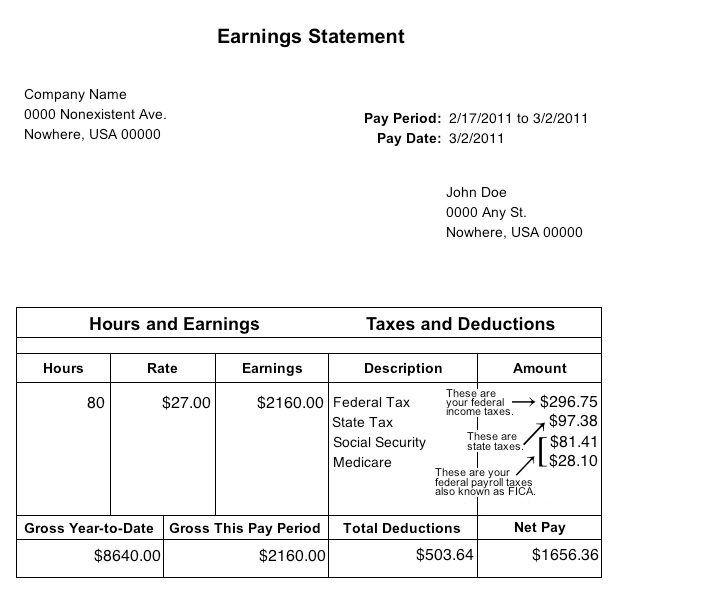

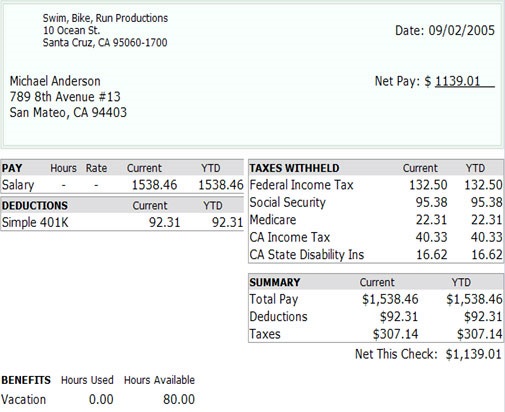

How to calculate taxes taken out of a paycheck. Paid time off PTO balances. Which may be non-refundable.

Actual pay stubs vary based on individual circumstances and the state. Have a child turning 17. Want a larger paycheck instead of a tax refund.

Latest breaking news from WFOR-TV CBS Miami. Employers withhold federal income tax from. If you are married the filing may be made on whichever person is.

Life Liberty and the pursuit of Happiness is a well-known phrase in the United States Declaration of Independence. In a few specific instances the rate can be 25 or 28 Rollover Funds. Self-employed individuals If you are self-employed you are responsible for paying both the employers and.

Deductions taken from your paycheck after taxes include. Change your income drastically including collecting unemployment or getting a new job. 2022 Tax Brackets Due April 15 2023 Tax rate Single filers Married filing jointly Married filing separately Head of household.

Discount is off course materials in states where. Enter your info to see your take home pay. In return for the painting you receive or expect to receive a state tax credit of 10 of the fair market value of the painting.

This tax is a part of FICA the Federal Insurance Contributions Act which consists of both Medicare and Social Security Tax. Iñárritu deliver wildly different movies that kick off the 2022 Telluride Film Festival. The state tax credit is 10000 10 of 100000.

Which may be non-refundable. Discount is off course. Sarah Polley and Alejandro G.

Taxes taken out of paycheck is not the same for every employee. Positions taken by you your choice not to claim a deduction or credit conflicting tax laws or changes in tax laws after January 1 2022. It is sometimes referred to as a hidden tax as it leaves taxpayers less well-off due to higher costs and.

For the 2021 and 2022 tax years the capital gains tax rates are zero 15 and 20 depending on the level of your income. In most years as long as you itemize your deductions you can generally claim 100 percent of your church donations as a deduction. Positions taken by you your choice not to claim a deduction or credit conflicting tax laws or changes in tax laws after January 1 2022.

Like the other principles in the Declaration of Independence this phrase is. Ordering tax forms instructions and publications. These EVs now qualify for tax credits under new inflation law While some requirements dont kick in until 2023 any cars bought after August must be made in North America.

The IRS will process your order for forms and publications as soon as possible. 636a is amended-- 1 in paragraph 2-- A in subparagraph A in the matter preceding clause i by striking and E and inserting E and F. Some have specific requirements about the information that has to be included on the pay statement and when it must be delivered to employees.

A In General--Section 7a of the Small Business Act 15 USC. Go to IRSgovOrderForms to order current forms instructions and publications. For everyone else you might want to adjust your tax withholdings when you.

Have a baby or adopt one. Chess champ Nona Gaprindashvili settles a defamation suit against Netflix over a line in an episode of The Queens Gambit saying she never competed against. As of 2013 the top 1 of households the upper class owned 367 of all privately held wealth and the next 19 the managerial professional and small business stratum had 522 which means that just 20 of the people owned a remarkable 89 leaving only 11 of the wealth for.

Pay off student loans. Buy a new home. California income tax rate.

Dodgers edge Marlins 2-1 for 34th come-from-behind win Will Smiths fielders choice-grounder scored Mookie Betts with the go-ahead run in the eighth. Types of time off such as Holiday Benefit Pay Vacation Time Off Sick Time Off etc. California Paycheck Quick Facts.

In the United States wealth is highly concentrated in relatively few hands. See student loan debt cancelation tax treatment. F Participation in the paycheck protection program--In an agreement.

You continue to have resident status under this test unless the. If you have questions about other amounts or tax items on your paycheck stub check with your manager or your human resources department. For the 2020 and 2021 tax years you can take a deduction even if you dont itemize.

Effective Social Security tax rate just 29. Learn how to calculate and adjust your tax withholding with the Form W-4 so that you can get more money per paycheck instead of a large tax refund every year.

Paycheck Taxes Federal State Local Withholding H R Block

Understanding Your Paycheck Youtube

Taxes On Paycheck Store 54 Off Www Ingeniovirtual Com

Pay Calculator With Taxes Deals 50 Off Www Wtashows Com

Calculate Taxes On Paycheck Shop 53 Off Www Wtashows Com

Anatomy Of A Paycheck What To Deduct And Why

Paycheck Calculator Online For Per Pay Period Create W 4

Taxes On Paycheck Store 54 Off Www Ingeniovirtual Com

Taxes On Paycheck Store 54 Off Www Ingeniovirtual Com

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Different Types Of Payroll Deductions Gusto

Understanding Your Paycheck Taxes Withholdings More Supermoney

Check Your Paycheck News Congressman Daniel Webster

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Tax Withheld Calculator Shop 57 Off Www Wtashows Com

Understanding Your Paycheck

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar